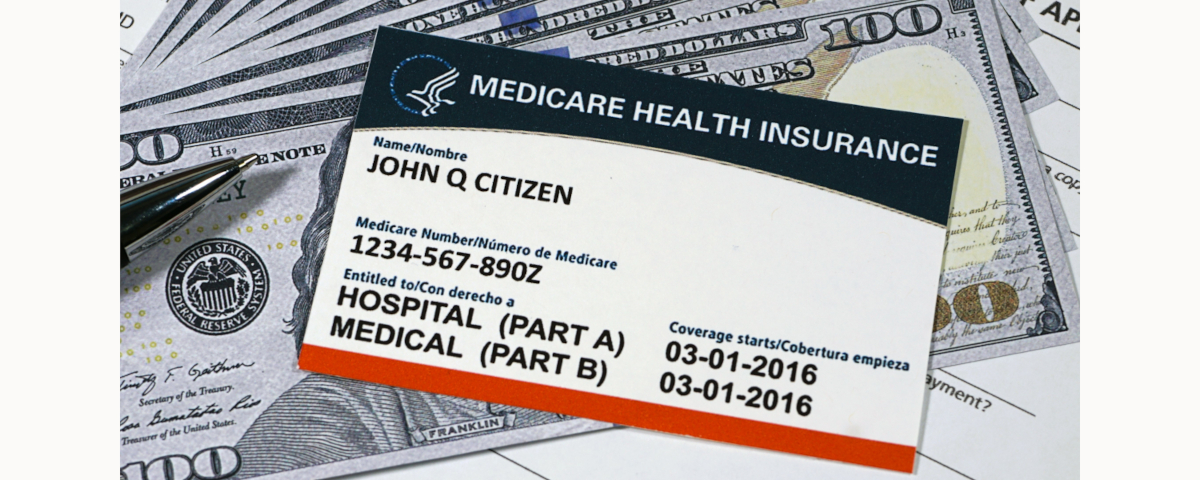

Safeguard Your Medicare Number: A Guide to Avoiding Fraud and Protecting Your Benefits

Medicare numbers are our gateway to vital healthcare services. But just like your Social Security number, they're confidential and require us to protect them since fraudsters are always seeking ways to exploit this information. So, it's important to be informed and vigilant in safeguarding your Medicare number.

Why Your Medicare Number Matters

Sharing your Medicare number carelessly can lead to several problems that can cause much more than just a headache:

- Identity Theft: A stolen number can be used to submit fake medical bills in your name, drain your Medicare benefits, and potentially harm your credit score.

- Scams: Beware of unsolicited calls, emails, or visits from people claiming to represent Medicare. Legitimate organizations won't pressure you to share your number over the phone. If you're unsure, hang up and find the verified contact information yourself.

Common Medicare Scams to Watch Out For

The Social Security Administration shows that Medicare fraud can cost Americans more than $60 billion a year. Some experts proclaim that the number may exceed $100 billion.

Medicare fraud ranges from relatively simple schemes to complex, highly organized crime rings. Here are the two most common forms of fraud beneficiaries are likely to face:

- Fake Equipment Bills: Scammers might offer "free" medical equipment and then bill Medicare for unnecessary items in your name.

- Phony Doctor Visits: They could fabricate doctor visits and bill Medicare for services you never received.

Sharing your number could also allow someone to:

- Change Your Plan: Without your knowledge, they might switch you to a Medicare plan with different benefits or higher costs.

- Limit Your Care: They could even restrict your access to specific doctors or specialists within your plan.

Protecting Your Medicare Number

Just like social security numbers, there are a few steps you can take to ensure your Medicare number remains safe:

- Be Cautious: Only provide or share your number with trusted sources like your doctor's office or a verified Medicare representative.

- Review Your Medicare Statements: Look for suspicious charges or services you never received.

- Shred Old Documents: Destroy any documents containing your Medicare number before throwing them away.

What to Do If You Suspect Fraud

If you suspect someone is using your Medicare number illegally, contact Medicare directly at 1-800-MEDICARE (1-800-633-4227) or visit their website at https://www.medicare.gov/.

By staying informed and following these tips, you can protect your Medicare number, your benefits, and your peace of mind.

Featured Blogs

- Life Insurance Myths Debunked: What You Really Need to Know

- The Best Mobile Apps for Seniors: Enhance Your Health and Daily Life

- Medicare Enrollment: Your Step-by-Step Guide with Senior Help and You

- Empowering Medicare Beneficiaries: Know Your Rights and Demand Better Healthcare

- Watchdog Urges Stricter Oversight of Medicare Advantage Home Visits

- Government Funding Laws: Addressing Budgets, Not Specific Issues

- 2025 Medicare Costs: Premiums, Deductibles, and Updates You Need

- Why Choosing an Independent Insurance Agent Could Be Your Best Decision Yet

- Exploring the Benefits of Whole Life Insurance Beyond Basic Coverage

- The Critical Role of Life Insurance in a Comprehensive Personal Finance Strategy

- A Layman's Guide to Choosing the Right Health Insurance Plan

- Flu Season Survival Guide

- Protecting Your Retirement Savings from Market Volatility

- CMS Alerts Medicare Beneficiaries of Data Breach Impact on Personal Information

- How Referrals Work in Medicare Advantage HMO Plans: What You Need to Know

- Maximize Your Medicare Advantage Plan Savings by Using In-Network Pharmacies

- Prioritizing Preventive Care in Your Wellness Journey

- Brown and White Eggs: What’s the Difference?

- DIY Disaster Preparedness Kit: Make your own disaster preparedness kit with these essentials to keep your property and family safe

- Why Supplemental Health Insurance Might Be Worth Considering

- Decoding Your Medicare Advantage ID Card: What You Need to Know for AEP

- Medicare Part B Giveback Benefit: What It Is, Pros, Cons, and Who It's Best For

- Coping with Senior Challenges: Loss, Downsizing, Relocation, and Online Safety

- The Benefits of Bundling: How Combining Policies Can Save You Money

- Health Savings Account: Is It Worth It Having it?

- The Impact of New Technology on Insurance

- Life Insurance Myths for Retirees: Get the Facts

- Healthy Living on a Budget: How Insurance Can Help You Save on Wellness Expenses

- Protecting Your Investments: The Role of Insurance in Wealth Management

- National Plan to End Parkinson’s Act: A Step Toward Better Care for Seniors

- Lack of Affordability Tops Older Americans’ List of Health Care Worries

- The Importance of Wills, Trusts, and Power of Attorney for Retirees

- Plan Annual Notice of Change (ANOC): What Retirees Need to Know

- Annuities for Retirement: Steady Income and Key Benefits

- How to Appeal a Medicare Decision: A Step-by-Step Guide

- Understanding Co-Pays vs. Coinsurance: Making Sense of Your Health Insurance Costs

- Insurance Myth Busters: Debunking Common Misconceptions about Coverage

- Understanding Your Health Insurance Deductible: Tips for Making the Most of Your Coverage

- The Evolution of Insurance: Trends and Innovations Shaping the Industry

- 2025 Social Security COLA Projected Increase and Impact on Benefits

- Medicare Premiums and Tax Savings

- How Medicare Covered Acupuncture Benefits Seniors

- UF Health's New Hybrid ER and Urgent Care Centers Aim to Streamline Patient Care

- Evaluating Medicare Advantage Core Services Star Ratings Plan Limitations

- Healthy Habits for the Summer: Tips for Utilizing Your Health Insurance Benefits

- How to Optimize Your Medicare Benefits: Coordinating ER, Hospital, SNF, and Home Health Care for a Full Recovery

- Why Medicare Advantage Service Claims are Denied

- The Future of Work

- Emergency Preparedness: How Insurance Can Provide Peace of Mind During Crises

- Managing Chronic Conditions: How Health Insurance Can Help You Stay Healthy All Year Round

- Navigating Insurance Renewals: Tips for Reviewing Your Policies

- The Importance of Preventive Care Coverage: How Your Health Insurance can Save You Money in the Long Run

- Unveiling the Impact of Conglomerates on Medicare: Choose Local Agents for Personalized Care

- Understanding Annuities, Life Insurance, and Medicare for a Secure Future | Senior Help And You

- Easy & Creative Ideas to Refresh Your Home for Summer

- Medicare Part D 2025 Changes: Inflation Reduction Act Benefits

- Understanding Medicare In-Patient Hospital Services

- Maximize Your Retirement with Indexed Universal Life Insurance | Senior Help And You

- The Essential Role of Critical Illness Insurance for Seniors

- Understanding Standardized Medicare Supplement Plans: Benefits, Coverage, and Costs

- Health Insurance 101: A Guide for Recent Graduates

- How Milestones Can Affect Your Coverage Needs

- How Types of Medicare Providers Affect Beneficiaries with Medicare Plans

- Decoding Medicare: Your Guide to Types of Medicare Providers

- Safeguard Your Medicare Number: A Guide to Avoiding Fraud and Protecting Your Benefits

- How to Fall Back Asleep After Waking in the Middle of the Night

- Embrace Strong Bones: Tips for Lifelong Health

- How to Improve the Air Quality in Your Home

- How to Avoid Muscle Loss as You Age

- Navigating Medicare Choices: Why Seniors Should Consider Medigap at Age 65

- The Rise of Urban Gardening

- Unlocking Financial Stability: Your Guide to Annuities 101

- Veterans Affairs Extension and Modification Act of 2023: Impact on Senior Veterans

- Navigating Medicare Telehealth: Clarity and Support with Senior Help and You

- A Complete Guide to Senior Dental Insurance: Unlocking Smiles

- Art of Mindful Eating: Transform Your Meals, Transform Your Life

- UnitedHealth Group Faces $1.6B Fallout from Change Healthcare Breach

- Social Security's Customer Service Crisis: Insights from Commissioner Martin O'Malley

- Fueling Your Mind with Brain-Boosting Foods

- Maximizing Medical Visits: 8 Tips for Successful Doctor Consultations

- Maximizing Medicare Preventive Services for Seniors

- Medicare Made Simple: Find Your Perfect Supplement Plan Today!

- 5 Simple Ways to Boost Your Immune System (and 1 unusual way)

- Embracing Our Roles: Renewing Our Commitment to Sustainable Living

- Tips for a Stress-Free Tax Season Experience

- Medicare Advantage Open Enrollment Period.

- Understanding Medicare enrollment

- Spring fitness ideas

- Understanding Medicare Special Needs Plan

- Understanding Your Medicare rights and Protections