Senior Help & You LLC

Are you feeling lost in your retirement planning journey?

Navigate Retirement with Confidence

Avoid the Pitfalls of Retirement Confusion

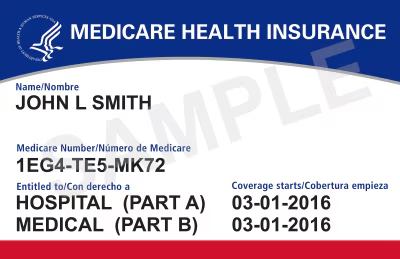

Are you navigating the maze of Medicare and insurance options?

Information overload on retirement options

Confusing Social Security claiming options

Fear of making the wrong decision

Missed opportunities for better options

Feeling overwhelmed by insurance choices

Lack of trustworthy guidance

Procrastination on important financial planning

Increasing anxiety about financial future

Schedule a consultation today!

Experience Peace of Mind in Retirement

Enjoy clarity and confidence as you plan your financial future.

Personalized assessments that fit your unique needs.

Expert guidance for Medicare and insurance choices.

Knowledgeable support from certified professionals.

Stress-free planning for your financial peace of mind.

We Understand Your Concerns

Count on our expertise for reliable and compassionate support.

Certified Professionals

Here to Help

Trust our RSSA and AHIP

certifications to guide you.

Hundreds of Satisfied

Clients

Join many who have found

clarity with our help.

Thanks to Senior Help And You, I finally feel secure about my retirement decisions.

Mary Thompson, Satisfied Client

Follow Our Simple 3-Step Process

Taking control of your retirement is easier than you think.

Schedule Your Consultation

We assess your unique needs and goals together

Receive Tailored Options

Get clear options designed for your situation.

Choose with Confidence

Select the best path with our expert guidance.

Thanks to Senior Help And You, I finally feel secure about my retirement decisions.

Mary Thompson, Satisfied Client

Your Peace of Mind is Our Priority

Navigating retirement shouldn't be stressful.

At Senior Help And You, we recognize how overwhelming the world of retirement planning and insurance can be for seniors. With countless options to sift through, it’s easy to feel lost and confused. That’s where we come in. Our team offers personalized consultations, guiding you step-by-step through Medicare plans, insurance coverage, and more. With our expertise, you can make informed decisions that secure your financial future and allow you to enjoy your retirement fully.

Contact Us

This is a solicitation for insurance. Important disclosures about Medicare Plans: Medicare has neither endorsed nor reviewed this information. Not connected or affiliated with any United States Government or State agency. We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction.

Copyrights 2025 | Senior Help And You | Terms & Conditions | Privacy Policy