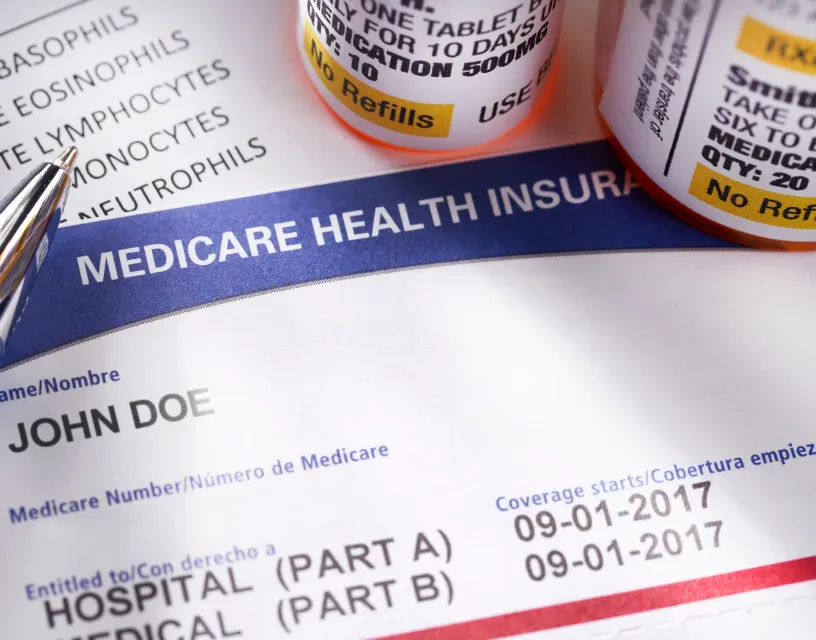

Medicare Part A & B Enrollment

Medicare can feel confusing, especially if you’re approaching 65 or are newly eligible due to disability. But enrolling in Medicare Part A and Part B doesn’t have to be stressful. These two parts—often called “Original Medicare”—form the foundation of your healthcare coverage in retirement. In this guide, we’ll walk you through what each part covers, who needs to enroll, when to sign up, and how to avoid costly penalties. By the end, you’ll have a clear roadmap for taking action.

3 Key Points You Should Know Before We Dive In

Part A is usually premium free if you worked and paid Medicare taxes for at least 10 years.

Part B has a monthly premium that can vary based on your income.

Missing your enrollment window can lead to lifetime penalties and gaps in coverage.

What is Medicare Part A?

Part A is hospital insurance. It covers inpatient care when you’re admitted to a hospital, skilled nursing facility care (under certain conditions), hospice care, and some home health services. Most people do not pay a premium for Part A because they or their spouse already paid Medicare taxes during their working years.

What is Medicare Part B?

Part B is medical insurance. It covers outpatient care like doctor visits, preventive services (like flu shots and screenings), lab tests, surgeries, durable medical equipment, and certain therapies. Unlike Part A, almost everyone pays a monthly premium for Part B. For 2025, the standard premium is $185 per month, although higher-income beneficiaries may pay more due to IRMAA (Income-Related Monthly Adjustment Amount).

When to Enroll

The best time to enroll in Part A and Part B is during your Initial Enrollment Period (IEP).

When it starts: 3 months before your 65th birthday month.

When it ends: 3 months after your birthday month

That’s a 7-month window. If you miss it and don’t qualify for a Special Enrollment Period, you could face a lifetime late enrollment penalty.

Special Enrollment Period (SEP)

You may delay Part B without a penalty if you have qualifying coverage through an employer (yours or your spouse’s). When that coverage ends, you’ll have an 8-month Special Enrollment Period to sign up for Part B.

How to Enroll

You can enroll in Part A and Part B:

Online at SSA.gov

By phone through the Social Security Administration

In person at your local Social Security office (appointment recommended)

Call Senior Help And You at 520-252-5275 for assistance.

Tip: Apply for both at the same time unless you have employer coverage and want to delay Part B.

Costs and Penalties

Part A Premium: $0 for most; up to $505/month if you don’t qualify for free Part A.

Part B Premium: Standard $185/month in 2025; higher if your income is above certain limits.

Part A Late Penalty: 10% more premium for twice the number of years you could have had Part A but didn’t.

Part B Late Penalty: 10% more premium for every 12-month period you delayed enrollment without other creditable coverage—for life.

Common Enrollment Mistakes

Assuming you don’t need Part B if you have COBRA or retiree coverage (not always considered creditable for Part B).

Missing your Initial Enrollment Period.

Thinking your spouse’s coverage automatically enrolls you in Medicare (it doesn’t).

Tips for Smooth Enrollment

Mark your calendar early—don’t rely on reminders.

Check your current insurance to see if it counts as creditable coverage.

Get help from a licensed Medicare agent to explore your options beyond Original Medicare.

Conclusion

Medicare Part A and Part B enrollment doesn’t have to be overwhelming. By understanding your eligibility, deadlines, and the steps involved, you can secure your healthcare coverage without costly penalties. At Senior Help And You, we specialize in guiding seniors through every step of the Medicare process. Our team makes it simple, stress-free, and tailored to your needs—so you can focus on enjoying your retirement with confidence.

3 Takeaways

Start your Medicare enrollment planning at least 6 months before turning 65.

Missing your enrollment window can lead to lifetime penalties.

Professional guidance can save you money and help you avoid costly mistakes.

Sources:

1. Medicare.gov – “Medicare Part A and Part B: Sign up or apply” (https://www.medicare.gov)

2. Social Security Administration – “Apply for Medicare” (https://www.ssa.gov/benefits/medicare)

3. Centers for Medicare & Medicaid Services – 2025 Medicare Costs Overview (https://www.cms.gov)

Author: Albert Ferrin, Senior Help And You